These reports give you insight into spending patterns to budget and analyze finances. Maintaining a standardized process will help the church ensure everything is accounted for, meeting compliance requirements, and also demonstrate transparency to the congregation. If your organization does not have the resources to maintain this process, you may want to consider outsourcing church bookkeeping. “In the church and nonprofit world, we’re appealing a lot of times to financial statement readers who are not accountants or not necessarily coming from a financial background,” our experts emphasize. This means reports need to serve both technical and practical purposes. Aplos is specifically built to serve the unique financial needs and dynamics of nonprofit groups and faith-based organizations.

Every well-organized house needs a blueprint, and so does your church’s accounting system. This blueprint is called a chart of accounts, a categorized list of all the accounts used to track your church’s financial activity. The best accounting method for your church depends on its size, complexity and financial goals. Consulting with an accountant can help you determine the most suitable approach for your ministry’s needs. If you find that your church is reliant on just one or two major funding sources, consider diversifying your revenue streams by exploring additional church fundraising ideas. This can increase your church’s financial stability so you have enough revenue to fund all of your activities if unexpected costs or circumstances arise.

It won’t do any good to wait weeks to record donations, because you need to know where your church stands at any given time. If Online Accounting you decide hiring an accountant or bookkeeper is the best choice for your business, you must choose someone suited to your needs. Here are some other ways to manage finances with limited resources. You may also go through reports during financial meetings to explain what each figure represents. Continue monitoring your budget by comparing the actual and expected outcomes of your financial activities.

Be aware of these forms to ensure the church complies with tax regulations and avoids penalties. Let’s explore the essential guidelines and best practices every church should follow to maintain financial integrity. When dealing with church finances, accuracy and transparency are crucial, and our church clients know that all too well.

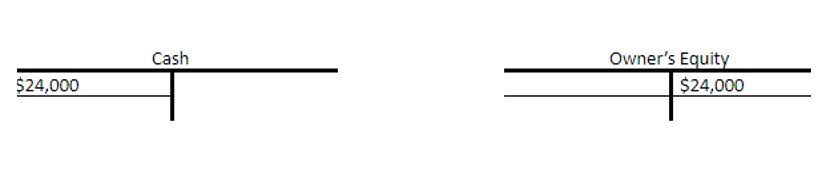

Effectively managing your church’s finances through sound accounting practices is critical for your church to grow. By maintaining a high level of accountability and transparency, you can both attract new members and build trust with your existing congregation. As you create your operating budget and report Restaurant Cash Flow Management on your finances, be sure to work with an accountant who has experience with churches to help you accomplish your financial goals. Bookkeeping means recording these actions to allow churches to pull reports to inform donors and the government on their financial history easily. When choosing accounting software, churches should first determine if the chosen software’s plans fit within their budget.

Over the last two decades, Josh has worked closely with pastors church accounting and other christian leaders, helping them to sharpen and elevate their messages. Today, Joshua pastors at New Life Fellowship, a thriving church he helped plant in Cambridge, Ontario, Canada. Churches that want to save money and error-proof their accounting via easy-to-use intelligent automations should consider Zoho Books. FreshBooks’ award-winning customer support means you never struggle to get assistance.